| Western Asset Prem Inst Liq Res Cap (WAAXX) | 5.42 |

| DWS ESG Liquidity Inst (ESGXX) | 5.40 |

| State Street Inst Liq Reserve Prem (SSIXX) | 5.39 |

| Allspring Heritage Select (WFJXX) | 5.37 |

| Federated Hermes Inst MM Mgmt IS (MMPXX) | 5.36 |

| Invesco Premier Investor (IMRXX) | 5.37 |

| First American Ret Prime Obligs X (FXRXX) | 5.36 |

| Allspring MMF Prm (WMPXX) | 5.35 |

| UBS Prime Preferred Fund (UPPXX) | 5.34 |

| Federated Hermes Prime Cash Oblig WS (PCOXX) | 5.34 |

| Federated Hermes Muni Obligs WS (MOFXX) | 4.11 |

| Vanguard Municipal MMF (VMSXX) | 4.07 |

| Fidelity Inv MM: Tax Exempt I (FTCXX) | 3.97 |

| BlackRock Liq MuniCash Inst (MCSXX) | 3.93 |

| UBS Tax-Free Preferred (SFPXX) | 3.88 |

Money Market News

MORE NEWS »Federated Hermes, the 6th largest manager of money funds, reported Q1'24 earnings and hosted its Q1'24 earnings call late last week. On the call, President & CEO J. Christopher Donahue, comments, "We ended the first quarter with record assets under management of $779 billion, driven by record money market assets of $579 billion.... In Q1, we reached another record high for money market fund assets, money market separate account assets and total money market assets.... Total money market assets increased by $19 billion during the first quarter from year end. Money market strategies continue to benefit from favorable market conditions for cash as an asset class, elevated liquidity levels in the financial system, and attractive yields compared to cash management alternatives, like bank deposits and direct investments in money market instruments like T-bills and commercial paper. In the long-expected, upcoming period of declining short term interest rates, we believe that market conditions for money market strategies will continue to be favorable compared to direct market rates and bank deposit rates."

Inside Money Fund Intelligence

MFI PDF April 2024 Issue |

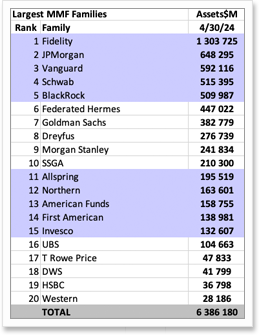

Largest Money Fund Managers |

|

|

The April 2024 issue of Money Fund Intelligence features: "Pending Reforms Trigger Prime Shift: Federated, Vanguard Go," which covers the budding exodus from Prime Institutional MMFs; "Bond Fund Symposium '24: Ultra-Shorts Look for Bounce," which quotes from our recent ultra-short bond fund conference; and, “Worldwide MF Assets Break $10 Trillion in '23; US Leads," which reviews ICI's latest global money fund statistics. Each monthly issue of Money Fund Intelligence features news, performance information and rankings on money market mutual funds. Statistics include: assets, weighted average maturity, weighted average life, expense ratio, 7-day yield, 30-day yield, 1-year, 3-yr, 5-yr, 10-yr, and since inception return, as well as 7- and 30-day gross yields. MFI also contains tables of the top-yielding and the largest money funds, and our benchmark Crane Money Fund Indexes. Subscriptions are $500 a year, and include online access to archived issues and additional features. Bulk discounts and site licenses are available. Write info@cranedata.com or call 1-508-439-4419 to subscribe or to request more information. |

The table below is excerpted from our monthly spreadsheet product, Money Fund Intelligence XLS. It shows the largest money market mutual fund managers as of March 31, 2024. (MFI XLS contains percentile rankings, fund family rankings, MNAVs, WLA, portfolio composition, and more).

|

|

About Crane Data LLC

Crane Data is a money market and mutual fund information company founded by Peter G. Crane and Shaun Cutts. We collect money market mutual fund, bank savings, and cash investment performance, statistics, and information and distribute rankings, news, and indexes.

Crane Data publishes Money Fund Intelligence, Money Fund Intelligence XLS, Money Fund Wisdom, the Crane Money Fund Indexes, and a series of products tracking money markets, mutual funds and cash investments. We also produce conferences, including Crane's Money Fund Symposium. For more information and samples, e-mail info@cranedata.com or call us at 1-508-439-4419.

Link of the Day

MORE LINKS »

Apr 28

WSJ: Regulators Seize Another Bank

The Wall Street Journal writes, "Regulators Seize Troubled Philadelphia Bank, Republic First." The piece states, "Regulators seized the troubled Philadelphia bank Republic First Bancorp and sold it to fellow regional lender Fulton Financial, the fourth high-profile bank failure since last spring. The bank was closed by the Pennsylvania state ...

People

more »

Apr 24

Birdthistle Out at SEC; Vij Greiner In

A press release tells us, "The Securities and Exchange Commission ... announced that William Birdthistle, the Director of the Division of Investment Management, will depart the agency.... Natasha Vij Greiner, currently the Deputy Director of the Division of Examinations, will be named Director of the Division of Investment Management."

Mar 04

GLMX Promotes Giglio and Wiblin

A release titled, "GLMX Promotes Giglio and Wiblin as Expansion Continues" says, "GLMX, a comprehensive global technology solution for trading Money Market instruments, including repurchase agreements, ... announced [that] Sal Giglio, previously COO and Chief Markets Officer, has been promoted to President and Chief Revenue Officer. Andy Wiblin, previously Chief Product Officer, has been promoted to Global Chief Operating Officer."

Feb 26

Straker Moves to Federated Hermes

Jason Straker is now a VP & Senior Sales Representative with Federated Hermes. He was previously with Western Asset.

Crane Data News & Features

contact us »Money Fund Symposium Pittsburgh, 6/12-14

Get ready for Crane Data’s big show! Money Fund Symposium will be held June 12-14, 2024, in Pittsburgh, Pa. Register and make hotel reservations soon. Also, thanks to those who attended our recent Bond Fund Symposium in Philadelphia! Next year's BFS will be held March 27-28, 2025 in Newport Beach, Calif. Mark your calendars for our European Money Fund Symposium, which will be in London, Sept. 19-20, 2024, and our Money Fund University, which will be in Providence, Dec. 19-20, 2024. Conference recordings and materials are available at the bottom of our "Content" page. Watch for more details on future shows in coming months, and let us know if you'd like more information. We hope to see you in Pittsburgh in June, in London in September or in Providence in December 2024!